The Basics of CFD Trading: How It Works and What You Should Know

The Basics of CFD Trading: How It Works and What You Should Know

Blog Article

What You Need to Know About CFD Trading to Succeed

Agreement for Difference (CFD) trading offers investors a unique method to deal financial markets without owning the underlying asset. It has gained popularity for the mobility and prospect of large returns, but like any trading technique, it requires ability and understanding to succeed. Whether you're a beginner or seeking to improve your strategy, below are a few specialist tips and strategies to help you maximize of cfd trading.

1. Realize the Principles of CFD Trading

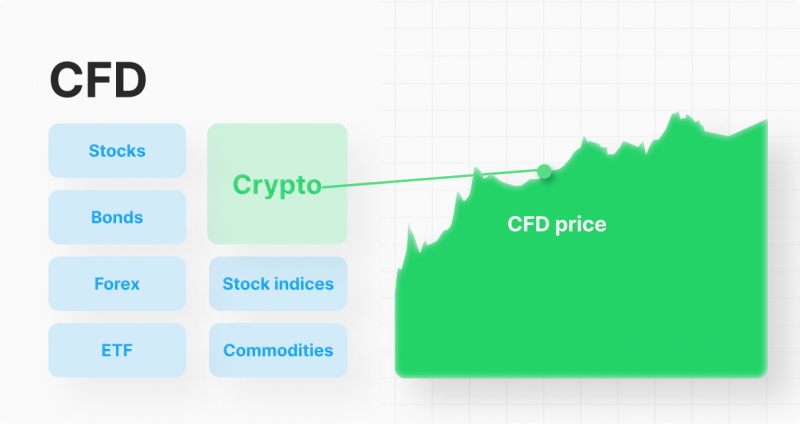

CFD trading allows you to imagine on the cost action of assets such as shares, commodities, forex, and indices. Whenever you enter a CFD deal, you're accepting to switch the huge difference in the price tag on a tool between the full time you start and close the contract. This means you are able to make money from both increasing and slipping markets.

Before moving in, it's important to truly have a strong comprehension of how CFDs function, along with the related risks. Make an effort to familiarize yourself with key phrases and ideas such as distribute, profit, and agreement sizes to help with making informed trading decisions.

2. Employ Variable Influence Correctly

One of the very fascinating top features of CFD trading is flexible influence, allowing traders to control bigger roles with an inferior capital outlay. But, while control can increase gains, in addition it magnifies possible losses. Use power cautiously and assure you are more comfortable with the level of risk it presents into your trading.

3. Create a Chance Administration Strategy

A great chance management approach is vital in CFD trading. Always set stop-loss requests to limit possible deficits and defend your capital. Moreover, establish the quantity of money you're willing to chance per trade and stay glued to it. Never chance significantly more than you are able to lose, as trading inherently holds some degree of risk.

4. Keep Updated with Industry News

CFD costs are extremely inspired by industry information and world wide events. Remaining current on financial reports, geopolitical developments, and industry message can help you foresee value movements. Use trusted information sources and contemplate adding essential evaluation into your trading technique to make better-informed decisions.

5. Pick the Right Areas to Deal

CFD trading supplies a wide variety of areas to deal, but not totally all areas might suit your trading style. Some markets are far more unpredictable, providing higher potential gains but also higher risks. Others tend to be more stable, that might match risk-averse traders. Evaluate the market situations and choose the ones that align with your chance threshold and strategy.

Conclusion

CFD trading can be a worthwhile knowledge when approached with information and strategy. By understanding the fundamentals, applying control reliably, managing risk, and keeping knowledgeable, you are able to raise your likelihood of success. Remember, trading is a ability that improves with time and experience, so have patience and continue learning as you go. Report this page